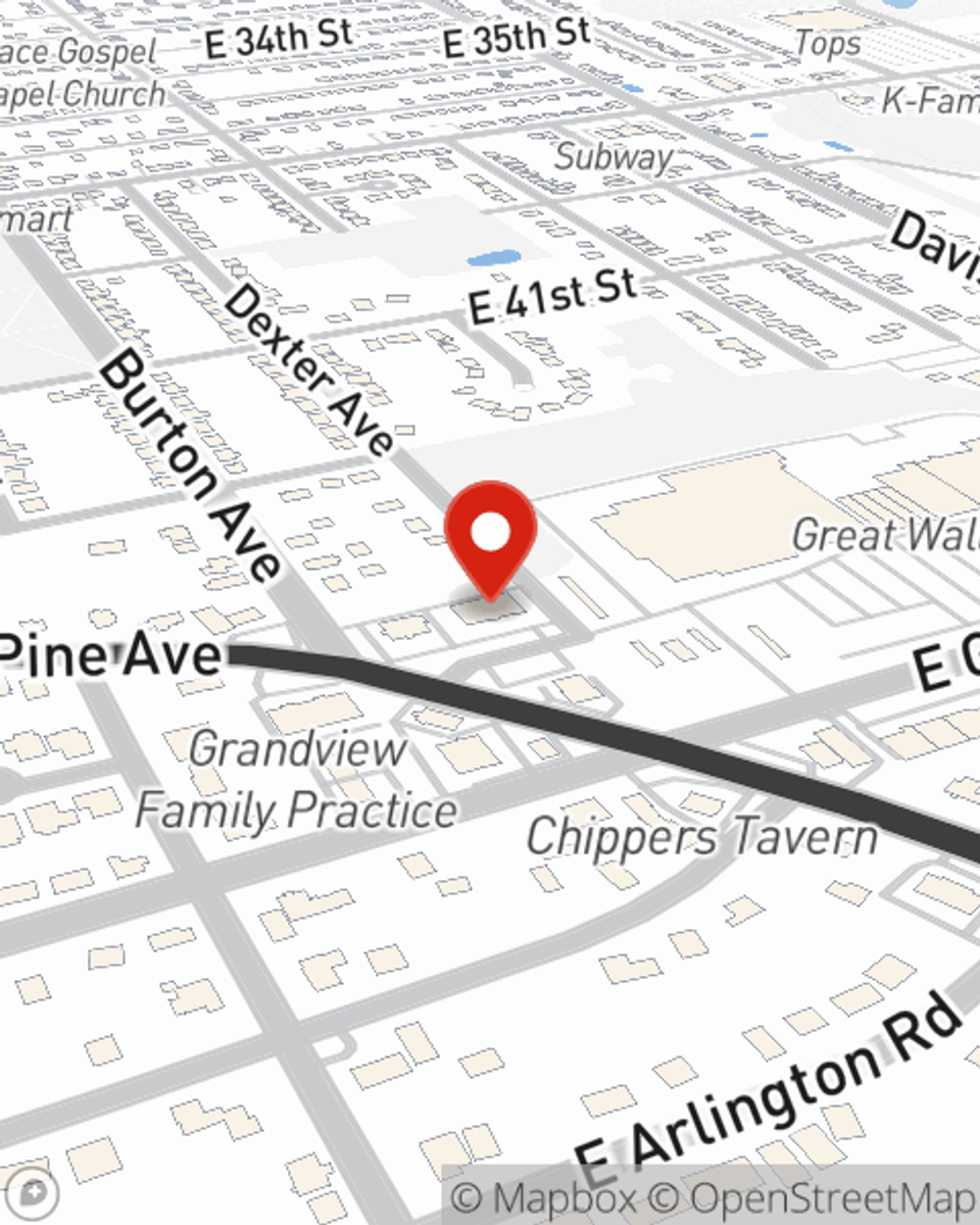

Renters Insurance in and around Erie

Get renters insurance in Erie

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

Protecting What You Own In Your Rental Home

Home is home even if you are leasing it. And whether it's a condo or a house, protection for your personal belongings is a good idea, even if your landlord doesn’t require it.

Get renters insurance in Erie

Your belongings say p-lease and thank you to renters insurance

State Farm Has Options For Your Renters Insurance Needs

It's likely that your landlord's insurance only covers the structure of the space or home you're renting. So, if you want to protect your valuables - such as a stereo, a recliner or a dining room set - renters insurance is what you're looking for. State Farm agent Chris Wertz has a true desire to help you evaluate your risks and protect yourself from the unexpected.

Renters of Erie, reach out to Chris Wertz's office to explore your particular options and the advantages of State Farm renters insurance.

Have More Questions About Renters Insurance?

Call Chris at (814) 452-4609 or visit our FAQ page.

Simple Insights®

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.

Do you need earthquake insurance if you don't live on the coast?

Do you need earthquake insurance if you don't live on the coast?

According to USGS, various U.S. locations have experienced earthquakes of magnitude four or more in recent years. Earthquake insurance can be valuable to all homeowners.

Chris Wertz

State Farm® Insurance AgentSimple Insights®

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.

Do you need earthquake insurance if you don't live on the coast?

Do you need earthquake insurance if you don't live on the coast?

According to USGS, various U.S. locations have experienced earthquakes of magnitude four or more in recent years. Earthquake insurance can be valuable to all homeowners.